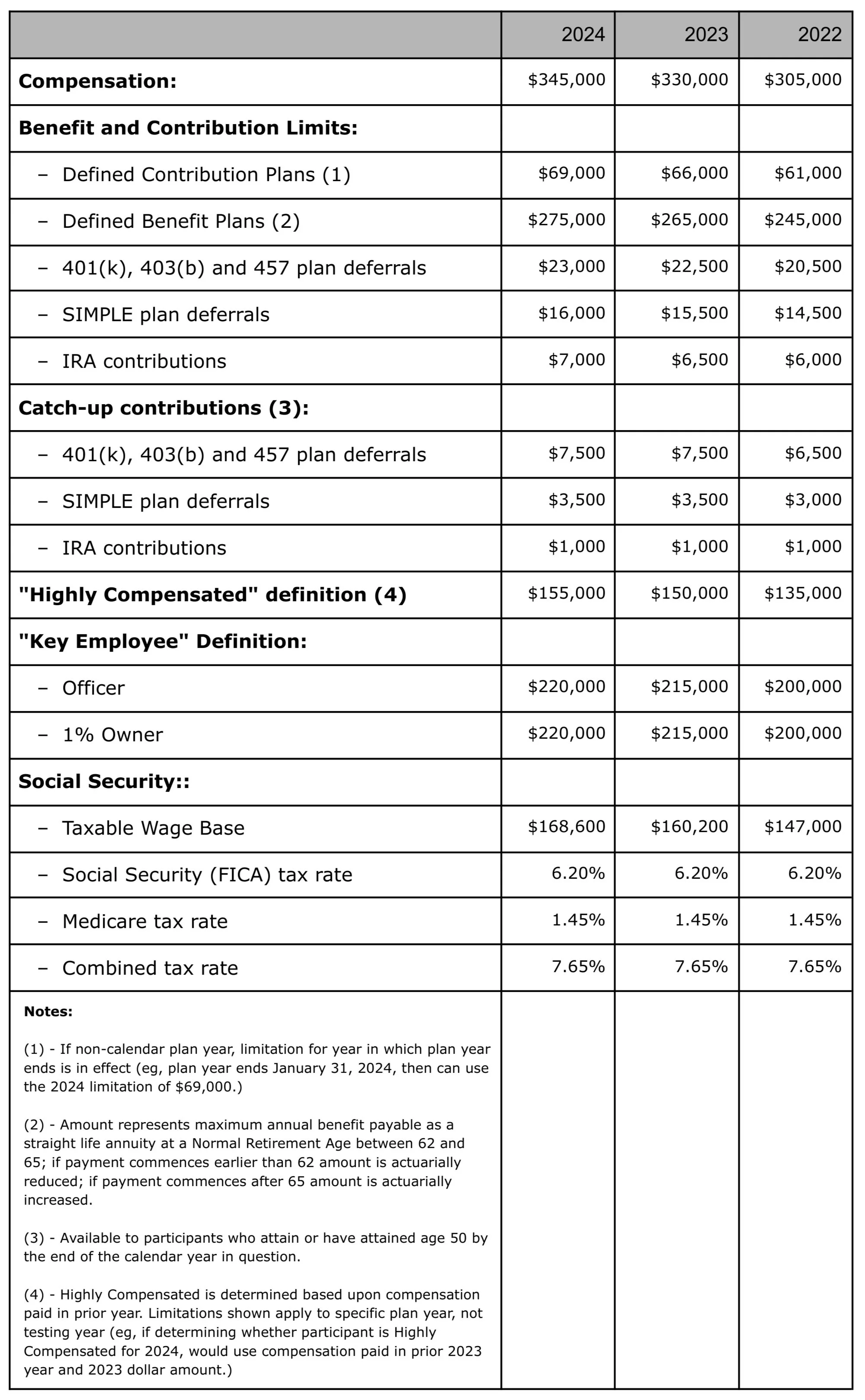

Qualified Retirement Plan Annual Limitations

Each retirement plan year, the annual compensation plays a crucial role in determining how employer contributions are allocated among participants, including their own deferrals or voluntary after-tax contributions.

Did you know in 2024 you and your employees can contribute $23,000 to your 401(k)-retirement plan, plus another $7,500 if you are over age 50?

A Detailed Overview:

Our team of specialists are here to walk your company through the in and outs of your retirement plan… every step of the way.

Questions? Click below to get the answers you deserve.